You Better Not Miss These Global Mega-trends In Automotive Interiors

Today, the Automotive Industry is the 4 th largest spender on Research and Development behind healthcare, software, and electronics. The key goals of research are Sustainable Design, Safety and User Experience. Automotive Interiors and In-Vehicle Experience are one of the key trends in achieving these goals. Identifying the smart interiors as a mega trend in the automotive industry in India as well as abroad, Quanzen initiated a 3 article long series on automotive smart interiors and the demand of components and technologies to meet the new demands. Our first article shared a bird’s eye view of the advancements in the smart interiors. In the second article we spoke about specific technologies and what global OEMs and Tier-1s are working on when it comes to smart interiors.

Some of the technologies that we covered in our earlier article are smart surfaces, connectivity features and interfaces, HMI – functional surfaces, voice commands, Safety – interiors, ADAS, driver monitoring systems, customer convenience features, Interior lighting – decorative ambient lighting (floor, roof, door), New materials – Lightweight, eco-friendly, new touch and feel, Car interior as protector and shield – interior air quality (IAQ), hygiene, acoustics & NVH etc. The third article in this series talks specifically about components and technologies that are required to engineer and manufacture the above-mentioned features and functionalities.

Automotive Cameras

As ADAS become regulatory requirement in more and more countries, the penetration of camera-based monitoring systems will increase tremendously. In a country like India, where at present very few automotive camera manufacturers exist, the market is almost like a Greenfield for global players. As per a study by Markets & Markets, like many other countries, dash cameras will become more popular in India as well in near future. According to a survey of primary respondents, by 2023, an average car will deploy more than two cameras; a trend which will eventually be a norm in India as well. Even reputed Tier-1s are working towards developing

integrable and reliable automotive camera systems and are looking for Tier-2s and

3s who can supply the required components.

In Mould electronics and Field Insert Moulding

As we discussed in our earlier articles, IME and FIM are two very promising technologies when it comes to providing immersive interiors that also aid the light-weighting of the vehicle. In cars, decorative formable films are suitable for instrument and door panels, switches, bezels, and Centre consoles which are finding increasing demand in the Indian Automotive market. Hence, technologies, components, machinery, and materials required for these two processes will also see sharp rise in demand in the near

future.

Screens and HUDs

The conventional analog gauges and knobs will also be replaced by HD touchpad with haptic response. Infotainment systems aimed at co-passengers are also a major trend which will fuel the demand for screens. Among all the components, screens and HUDs will be the ones witnessing the largest demand.

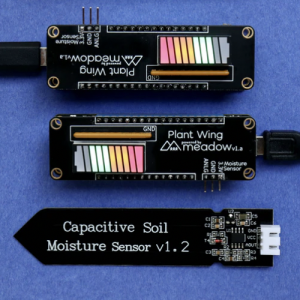

Sensors

Intelligence is synonymous with sensors. In-cabin monitoring systems, driver monitoring systems, smart infotainment and vending systems all need sensors to begin with. Proximity sensors, light sensors, motions detectors, infrared sensors,

air quality sensors, occupancy detection sensors and numerous more sensors will find their usage increasing drastically leading to an upsurge of demand.

Haptics

Many specialists have raised concerns about the distraction caused by touch screens and their low response times. Many OEMs have already introduced haptic and tactile response in seats, touch screens, accelerator pedals etc. OEMs like Audi, GM etc. and Tier-1s like Bosch and Continental are pioneering the development in this field. Tier-2 suppliers have huge business case to tap into this almost green opportunity.

Plastics and Polymers

Lightweight polymers, anti-bacterial polymers, NVH compliant polymers and many other specialty plastics and polymers are unavoidable to accomplish the smart interiors objectives. OEMs and Tier-1s are looking for innovations in plastic and polymers that can help them achieve their respective targets.

Light-weighting

A mega trend in itself, light weighting goals of the OEMs are resulting into many changes in the car interiors. Seats, dashboards, structural components, upholstery are all being re-designed using newer materials. Use of aluminum, magnesium, carbon composites, advance lightweight polymers is increasing like never before opening a whole array of opportunities.

Lights

Innovative lighting components like plastic LEDs, acrylic fibre optic light

tubes, light emitting surfaces will be more and more in demand as we need better

ambient lighting, overhead lighting, backlit buttons etc. in the cars.

Adhesives and Specialty Chemicals

More intricate assemblies, need to

seamlessly join different materials, light-weighting goals, NVH requirements are all

coming together resulting in demand for adhesives and specialty chemicals in cars.

Sustainable Materials

As sustainability itself becomes a mega-trend, components

like handles, upholstery, consoles made of sustainable and even vegan materials will

gain traction.

The Indian Context

India follows technologically advanced countries in terms of regulations and comfort features with a lag of 2-3 years. Due to aspirational buyers, smart interiors and features like HMIs – touch screens and HUDs, connected features – voice command, gesture control and safety features – HUD, occupancy detectors are becoming increasingly popular in India offering a huge opportunity for companies that manufacture required components or technologies.

India is not only one of the biggest automotive markets in the world; it is probably the most unique as well. In India, top 5 positions in any vehicle segments are dominated by local Indian OEMs. Hence most of the decision making at the large Indian OEMs happens in India itself, unlike many other large foreign companies where only vehicle production takes place, but the Engineering & Development decisions are made somewhere else at the MNC headquarters. Hence there is a huge opportunity opening up at OEMs in India, for the new automotive interior technologies and the component suppliers for the same.

Secondly, several major global OEMs and Tier-1 companies have their Research and Development centres in India, hence a new foreign supplier of smart interior components can introduce new and innovative technologies in Indian Tech Centers in R&D projects for global markets. Global suppliers can get access to these opportunities by various ways – running business development initiatives, technology licensing, collaborations etc.

To know more contact me at sudhir.nerurkar@quanzen.com.